HELLO, WELCOME.

WE ARE

OVERCOMING YOUR FINANCIAL OBSTACLES

BY IMPROVING YOUR CREDIT SCORE

We repair your credit report to put you on the path to financial freedom

turn dreams into reality to give you a brighter future

95% success rate of improving your report

or your money back.

Asia Pacific Stevie Award 2024

We are beyond excited to share that we have been awarded by Asia Pacific Stevie Award 2024 (Gold Stevie Award) for Innovation in Customer Service Management, Planning & Practice | Financial Services Industries.

The Stevie® Awards are the world's premier business awards. They were created in 2002 to honor and generate public recognition of the achievements and positive contributions of organizations and working professionals worldwide. In short order the Stevie has become one of the world's most coveted prizes.

This award is a reflection of our team’s relentless drive to excel and innovate in every aspect of our service.

A heartfelt thank you to our team for their hard work and Thank you to everyone who has supported and believed in us

Women in Finance Awards 2023

We are excited to share the wonderful news that Credit Success has been selected as a finalist for the prestigious Women in Finance Awards: Entrepreneur of the Year category. This recognition places us among the outstanding women who are making a significant impact on the Australian finance industry.

The Women in Finance Awards have emerged as a national benchmark for excellence, honoring those women who have demonstrated unwavering dedication to driving the industry forward. These awards serve as a celebration of the accomplishments of exceptional women across various sectors within finance, including brokers, accountants, bookkeepers, banking and finance lawyers, CEOs, entrepreneurs, thought leaders, and the promising stars of tomorrow.

At Credit Success, we are immensely proud to be a part of this esteemed group of nominees, and we remain committed to delivering excellence in the financial industry. Thank you for your continued support as we strive to make a positive impact on the finance landscape in Australia.

Fixing your credit report doesn't have to be hard.

Get a FREE credit evaluation

Including access to your

- Credit score

- Credit summary

- Credit report

- Free consultation to hear your solution options and

- Free education on continuously improving and maintaining your credit score

Your credit score matters

The average credit score in Australia is 695 however 853 or higher increases your borrowing power.

Why is that a good thing?

1 in 4 chance of error

There is a 1 in 4 chance that your credit report has an error that needs correcting.

Boost your credit score

Repairing your credit report helps to boost your credit score.

Become 'mortgage ready'

Health check your credit score & report to make sure you're on the right path to be offered a lower interest home loan.

Lower your interest rates

Refinance and consolidate your loans to lower and save on interest.

Kerry and her team at Credit Success are an absolute asset in the finance industry, and we are so glad we found her! Kerry has extensive knowledge in the finance industry, and her years of experience show through her work. Her promptness, attention to detail and dedication to her work adds to the service and you can relax knowing that Kerry can look after your finance details wonderfully, thank you!

Rhianna Morris, Director

My Savvy Broker

Kerry has helped many of our clients that have gone through tough personal situations and need someone to guide them through the process of clearing their credit. Kerry’s compassion and experience is clear to see when you speak any one who has dealt with her and Credit Success. Kerry has enabled people to be able to achieve buying their first home who never thought it would be possible considering their credit record.

Meg Bates

Credit Success client

When it comes to credit repair there are certainly cowboys out there and having worked with kerry a number of times in the past with my clients I know they are in good hands. Getting a clean bill of health on a credit file can absolutely change lives and you wont get someone more invested in your clients best interests. Communication, transparency and putting the customer first is what you can expect so give them a go!

Daniel Rees - Dip FS (FMBM) C.dec

Slide title

We can not recommend Credit Success enough.

We had tried another repair company who was not able to get a fraudulent mark removed.

Credit Success kept me in the loop through the whole process and was able to get the job done.

Thank you so much to the Credit Success Team.

Happy Successful Client

Button

Slide title

I have known Kerry for many years and she is very professional and is very knowledgeable and well respected in the industry.

I would refer any customer to Kerry if they have any credit concerns.

My State

Button

Slide title

Kerry and the team at Credit Success are passionate about helping their clients get the best possible outcome and putting them on a path to success. They are knowledgeable and so easy to work with. There is no judgement from them, just support and hard work to get their clients on track. I highly recommend Credit Success to my clients to assist them in preparing to apply for mortgage finance – and get the loan they want to achieve their property goals!

Peta-Louise, Boutique Broker

Button

We guarantee we will improve your credit report - or your money back*

Remove bad credit - 95% success rate

Our professional team has over 20 years experience in finance & credit repair.

Getting started is simple!

STEP ONE

Contact us by filling in the 'apply now' form, including a personal story so we can understand your case. Or call us directly. Call 1800 956 694 or admin@creditsuccess.com.au.

STEP TWO

Credit Success will review your application or enquiry, and one of our friendly team members will contact you within 24 hours by calling you contact number. If we are unable to get hold of you, we will send you an email for follow up.

STEP THREE

Once we have discussed your case with you and confident we are able to take on your case. We will send you our link to our application and privacy forms to get started. The process in repairing your credit report can take up to 8 weeks for more complicated cases.

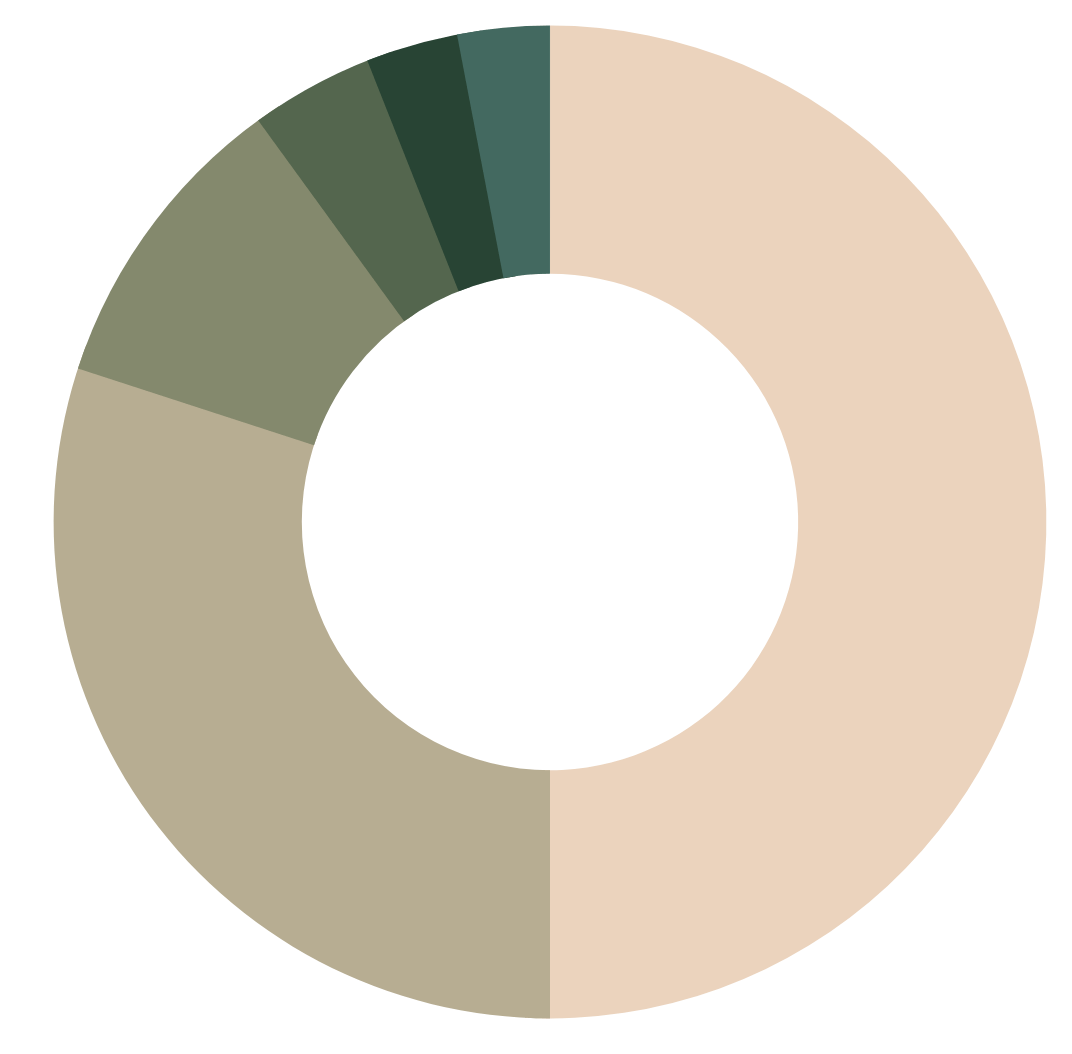

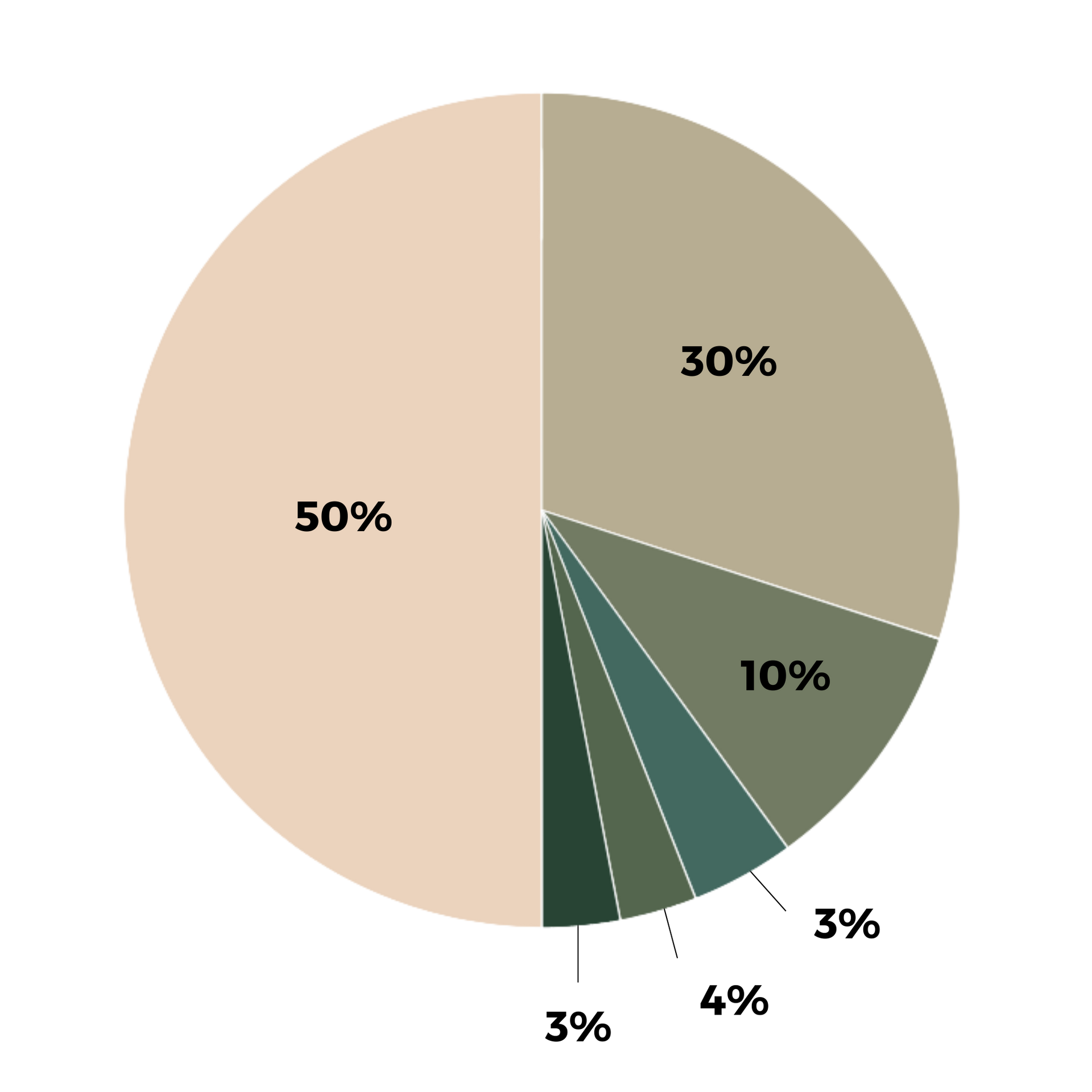

What contributes to your credit report?

Your credit report is based off a combination of factors and determined by credit bureau assessments

50 % Credit Applications & Enquiries

How many times you have applied for credit accounts

30% Repayment History

24 months for credit cards, loans, mortgages & utilities

10% Adverse Events

Defaults, debt agreements, insolvencies, etc.

4% Credit Limits

How long your credit accounts have existed.

3% Credit History

How high your credit card and loan limits are.

3% Personal Information

Your personal details.

*The percentages in this chart show how important each of the categories is in determining your credit score. The components + percentages are subject to change between credit reporting bureaus and lenders across Australia. Different credit reporting agencies have different criteria as to how they calculate your credit score.

Credit Applications & Enquiries

How many times you have applied for credit accounts

Repayment History

24 months for credit cards, loans, mortgages & utilities

Adverse Events

Defaults, debt agreements, insolvencies, etc.

Credit Limits

How high your credit card and loan limits are.

Credit History

How long your credit accounts have existed.

Personal Information

Your personal details.

Subscribe for free education & advice

We will get back to you as soon as possible.

Please try again later.

Let's get Social

Follow @creditsuccessau for regular advice on Instagram

-

Follow our TikTok page: creditsuccessau Special guests, The Sainsbury Family. Admin@creditsuccess.com.au 1800 956 694 #creditscore #creditrepair #creditreporting #creditreportingeducationButton

-

4 tips for Christmas. -Budgeting can prevent further finance requirements in the new year! #creditreportingeducation #beawareofyourfinances #letsgetsmarter #futuregoals #creditrepair admin@creditsuccess.com.au 1800 956 694 We are still open for two more days!Button

-

We wish you all a magical Christmas and the most amazing 2024. We will be closed from the 23rd of December and back from the 2nd of January. Love the team at Credit Success 💥Button

-

Credit Success Represent ✌️ #courtjudgment #creditrepair #support #makingadifferenceButton

-

3 Defaults removed in two weeks now that’s what we call success 💥 #creditrepair #defaults #success #creditreportingeducationButton

-

It’s the 1st of December 🎄 I love our team!! We wish you all a magical festive season.Button

-

Kerry's Friday tip! Have a lovely weekend, I thought I would share a question that comes up a bit. Taking out credit just for a credit score or to increase a score is a complete myth. #creditrepair #creditscore #protectingyourcreditscore #googlesmyth #education #valueaddButton

-

Happy Broker, Thank you Cameron. We pride ourselves on our service to all parties. #supportingbrokers #valueadd #happyclients #results #creditrepair #5starsButton

-

**Team Member Profile** Introducing the beautiful Tess to our team. Tess is our most newest addition to our team and holds the role of our Sales Support Specialist. Tess completed the missing piece to our puzzle. Tess looks after the front end of our business. Tess’s empathetic nature and passion for helping people makes her the perfect fit. Tess also comes with a Finance and Insurance background. We can’t wait for you to have the pleasure of meeting Tess 🙌🏼Button

-

Our services come with a 98% success rate 🙌🏼 There is also no fee if we are unsuccessful. Admin@creditsuccess.com.au 1800 956 694 #creditrepair #helpingpeople #doingtherightthing #supportingmentalhealth #creditreportingeducationButton

-

Kindness makes the world go around 🙌🏼 We are here to help. Admin@creditsuccess.com.au 1800 956 694Button

-

Wow, what an absolute honour it was to be in Sydney over the weekend for the Women in Finance awards 23. I connected with so many like minded business professionals. I am so proud of Credit Success in becoming a finalist in a national award in such a short time. What an achievement! I could not do it without my beautiful team of women @jheneybhel0806 @tessjays @joransome I have the most special team ❤️ Thank you @kelso_finance for being your Plus 1. I love your determination and how hard you work for your customers. Finalist in the top 10 female brokers of the year 💥 #womensupportingwomen #womeninfinance #creditrepair #creditreportingeducationButton

-

**TEAM MEMBER PROFILE** Introducing Jo Ransome to our team! Jo is our very first Business Development Manager. Jo is a familiar face to the finance and banking industry and has been in the industry for many years. Jo has also been a mortgage broker herself. Jo is a huge asset to the team and we look forward to you meeting Jo out and about for meetings and events. Her energy is contagious ☺️ Our beautiful Jo is also an AMAZING trauma therapist therefore Kerry and Jo have joined forces. We are offering Jo’s services with a special discount to our clients. We feel that our two businesses come together because we understand what the struggles of finances and life events can do to our mental health. We want to make sure our clients have the best kick start we possibly can give them. Jo is available on jo@creditsuccess.com.au or 0416 623 882. #teamisgrowing #creditrepair #creditreporting #traumatherapy #traumwtherapistButton

-

Our new PowerPoint presentation is out 👏 We love educating our partners on credit reporting updates. Please reach out if you would like an update, access to our marketing material, Blogs or posts. Admin@creditsuccess.com.au 1800 956 694 #creditreportingeducation #creditscore #bnpl #creditrepairButton

-

**TEAM MEMBER PROFILE** Meet our beautiful Jency! Jency has been with us since April 23! Jency came to us with US Credit Repair experience and is OUR Queen of negotiations. No Creditors want to mess with Jency. We and our clients appreciate all you do for us Jency. #oneteam #creditrepair #creditreportingButton

-

Another Day, Another Education Session to be held! We love providing updates on credit reporting. For all your credit reporting enquiries and updates: Admin@creditsuccess.com.au 1800 956 694 #supportingpartners #creditrepair #crediteducation #creditreportingButton

-

Credit Reporting education sessions, we think YESS ✅ Available to support in any school, tafe, University or professional development day 🙌🏼 #education #creditreporting #valueadd #creditrepairButton

-

**Interupting your Thursday for a credit reporting update** I had a broker ask me about enquiries today on credit reports: I decided to share my answer and create a post! I have found that enquiries are currently the hardest to remove. With defaults, late payments and court judgements we can find errors in the legislation/process and also look at compassionate grounds like loss of job, divorce etc. With enquiries, it is hard to find errors as the chances of finding errors are slim, because in most circumstances the client has applied for this even by the way of the internet and the creditor has a consent form signed. However, if you read the below article: The regulations around enquiries are due to change: I predict there may be changes in the near future in regards to Credit Success being able to remove errors on enquiries. https://www.oaic.gov.au/newsroom/credit-reporting-code-review-proposes-strengthened-privacy-protections admin@creditsuccess.com.au 1800 956 694 #creditreporting #creditrepair #understandingtheimportanceofyourcreditscore #creditscore #educationButton

-

Client Review Tuesday. Shirley is one happy customer who is one step closer to financial freedom. We love what we do @ Credit Success admin@creditsuccess.com.au 1800 956 694 If you love what we do, we would love a 5 star review: https://lnkd.in/g3rj-MRZ #creditrepair #changinglives #educatingourcustomers #credit-reportingButton

-

Thank you @cafba_social for a wonderful networking event supporting our commercial and asset finance partners. #creditrepair #creditscore #creditreporting #cafbaButton

-

What a pleasure it was to be invited to the @madd_loans team meeting this morning talking all about credit reporting and how we can assist clients. We not only repair reports but we work with you on the education journey. I have known @georgesamios_madd for many years and I have to say, he is inspirational to our Industry for what he has achieved and to continue to be so genuine and kind hearted is truly so lovely to see. #creditrepair #creditreportingeducation #valueadd #maddloans #supportingourbrokersButton

-

Boom 💥 Our official badge has arrived. #creditrepair #freecreditreportingeducation #doingrightbyourclientsButton

-

It is an absolute honour and a privilege to be notified today that we are a finalist in the 2023 Women in Finance awards, What a way to start the weekend 🙌🏼 https://www.womeninfinanceawards.com.au/winners/2023-winners-and-finalists?utm_source=mortgagebusiness.com.au&utm_medium=editorial&utm_campaign=womeninfinanceawardsfinalistsstoryfinalistslist&utm_term=WIF2023Button

-

One of our 5 star reviews from one of our first clients. I am so proud of our results we are achieving for our clients. We wake up every day consistently doing right by our customers and guiding them to financial freedom. Admin@creditsuccess.com.au 1800 956 694 #creditrepair #financialobstacles #dreambig #futuregoals #creditreporting #education #valueadd#Button

-

Our very first podcast. Thank you @waymakerfinance for the opportunity. I hope this brings more education and awareness around credit reporting.Button

-

What a privilege. Thank you @wswnetworkinggroup and @safehavencommunity for a wonderful event. Our first sponsorship 🙌🏼 #creditrepair #safehavencommunity #womensupportingwomenButton

-

A reminder of the recent changes to Buy Now Pay Later Schemes. Read more: www.afr.com BNPL accounts are being reported on your credit report for the previous 24 months repayment history. #bnpl #newregulations #creditreporting #educationButton

-

Did you know??? There is not just one credit reporting bureau. There are three in the consumer space!! If In doubt, please check all three and contact us for the websites to order a free report. 1800 956 694 or admin@creditsuccess.com.au #creditrepair #threecreditbureaus #creditreportingeducation #financialfreedom #change #changelivesButton

-

Meet our Founder and CEO: Kerry Sainsbury is the trusted, ambitious and compassionate founder at Credit Success. With over 20 years experience in the banking, finance & credit repair industries, Kerry has excelled throughout her career working as a Senior Business Development Manager & State Manager for a credit repair agency; for numerous lenders and was a broker for one of the big four banks. Kerry's series of professionally recognised qualifications has established herself as a well respected leader in the industry. After finding herself going through a messy divorce, Kerry found herself in a negative credit situation that drove her passion to help others correct their financial burdens. Kerry's passion for helping people is what drove her to combine her experience; mentor a modest team and create Credit Success. Now, Kerry and her team are focussing on the bigger picture; Repairing your credit score Education on your credit scores & reports Preparing our younger generation to build their best financial portfolio through free financial classes. Providing complimentary services to the guests of our charity partner, @safehavencommunity We want you to obtain the best possible position to achieve economic security in our ever-changing environment, so let's get you off on the right foot. Let's successfully change your life!Button

-

Habits to Help you Reach Financial Freedom. Please contact the team on 1800 956 694 or admin@creditsuccess.com.au We can help with any credit reporting hurdles and get you back on track with your financial goals and dreams. #financialfreedom #creditrepair #education #lifegoals #creditreportingeducationButton

-

Wishing you a very happy Women’s day to strong, intelligent, talented, and simply wonderful woman of this world! Don’t you ever forget that you are loved and appreciated. #internationalwomensday #creditrepair #heretosupport #womansday #financialfreedomButton

-

BNPL Schemes- The government is currently in the process of making a final decision on the future of BNPL regulation in Australia. Currently these schemes are not regulated meaning they are not subject to responsible lending standards or other requirements of the credit act. For now, please keep these points in mind. #bnplschemes #financialfreedom #creditreportingeducation #creditrepair #financialliteracyButton

-

NEVER MISS A PAYMENT Your credit report can be affected negatively. Always communicate with your financial providers. There is a grace period of 14 days however we recommend never missing your payments. #credittoptips #creditrepair #financialfreedom #creditreportingeducationButton

-

You are never too old to put new goals and dreams into place. Tomorrow is a new day 💫 Credit success is here to support your credit reporting hurdles which may be blocking your dreams. #financialfreedom #creditreporting #creditreportrepair #newgoals #dreamscometrue #creditreportingeducationButton

-

50/30/20 Budget Rule Go to: https://moneysmart.gov.au/budgeting/budget-planner For your free budgeting planner 💫 We are here for you. #creditrepair #creditreporteducation #budgetingtips #protectingyourcreditscore #financialfreedomButton

-

Happy New Year from all of us at Credit Success. Here are our 5 Top Tips for a New Year, New You in 2023. Our contact details are: Email- Admin@creditsuccess.com.au Phone- 1800 956 694. We are here for you 💫 #creditrepair #creditreportingeducation #financialobstacles #financialfreedom #creditsuccessButton

-

Merry Christmas from our family to yours. We look forward to working with you in 2023 💫 #creditrepair #comingsoon #creditreportingfreeadvice #financialfreedom #successButton

-

Watch this space 🙌🏼 #openingsoon #creditrepair #freecreditreportingadvice #financialfreedom #mortgageready #coming soon #creditsuccess #australiaButton

© CREDIT SUCCESS | ASIC LICENSE 546081 I AFCA MEMBER 99785 I ALL RIGHTS RESERVED | TERMS AND CONDITIONS | PRIVACY POLICY

Website by Strong Digital Marketing